20+ Estimate my mortgage

It also calculates the sum total of all payments including one-time down payment total PITI amount and total HOA fees during the entire amortization. The payment calculation may also include.

Rental Property Calculator Most Accurate Forecast

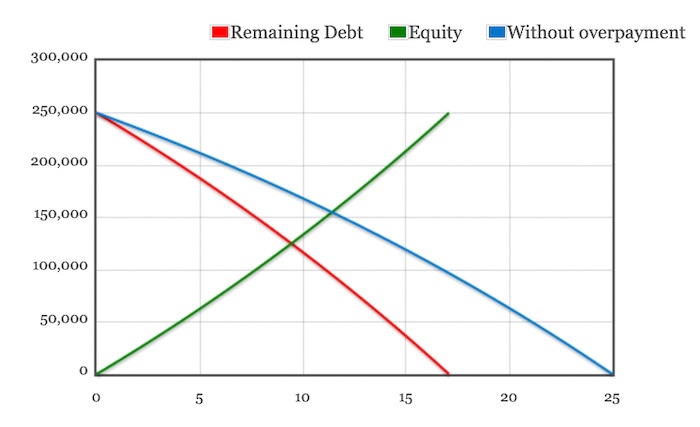

What I am trying to work out is when I reduce my term from 20 years to 12 years whether I am better to.

. This can be anywhere from 10 years to 30 years but entering 30 years will have the lowest payments and enable you to qualify for the highest loan amount. A fixed 20-year mortgage. The calculator will estimate your monthly mortgage payment including principal and interest plus taxes and insurance costs.

For starters it will help you avoid paying private mortgage insurance PMI and lower your monthly mortgage payments. Close Your Home Refinance Loan in Days Not Weeks. Compare a no-cost vs.

What is a 20-year fixed-rate mortgage. A 20-year fixed mortgage has a flat interest rate for the full 20 years. But you may not need that much.

Compared to the more popular 30-year mortgage a 20-year loan lets the homeowner shave a decade off the term and save significantly on interest payments over the life of the mortgage. Costs that can increase by up to 10 percent. Mortgage insuranceIf your down payment is less than 20 of the cost of your house many lenders will require you to pay an additional fee called private mortgage insurance or PMI.

The My Mortgage team is dedicated to making your mortgage lending experience remarkable effortless and enjoyable. Should I refinance my mortgage. The estimate isnt an application for credit and results dont guarantee loan approval or denial.

Should I convert to a bi-weekly payment schedule. 20-year fixed mortgage rates. Put 20 down or as much as you can for your down payment.

The infographic below looks at all the benefits of a 20 down payment for a mortgage. Take the first step and get prequalified. View estimated house payments on 30-year fixed and other popular loan terms.

Use this closing costs calculator to estimate your total closing expenses on your home mortgage including prepaid items third-party fees and escrow account funds. This is the rate you expect to pay on the loan youll receive. You may want a cash back mortgage if you need money for expenses such as new furniture or repaying loans to cover closing costs.

All home lending products are subject to credit and property approval. Enjoy our Fast Free Financial Calculators. There are a number of reasons why refinancing could be a great idea - the biggest being financial.

Fees paid to the lender mortgage broker or an affiliate of either the lender or mortgage broker for a required service. Click the view full report button to see the estimate. Try to avoid PMI private mortgage insurance if you can.

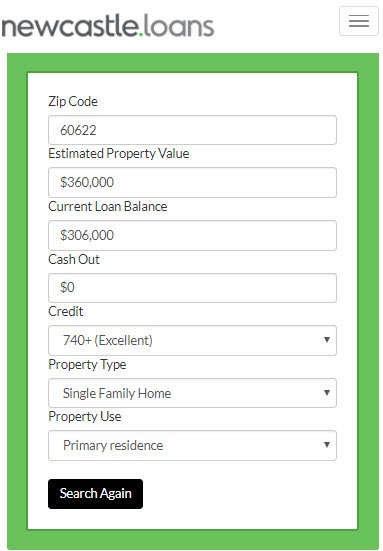

If you have a particular home in mind use that price as. Results of the mortgage affordability estimateprequalification are guidelines. Have the following information handy.

You can also use Credibles mortgage calculator to estimate your monthly mortgage payments. A 30-year mortgage will repay at a different pace than a 15-year or 20-year mortgage. Use our Cash Out Calculator to estimate some options.

The interest rates on these mortgages are higher than on some other mortgages. Choose a longer-term mortgage like a 30-year rather than a 15-year loan. Typically ranging between 5 and 20 of the purchase price.

The mortgage amount would be 200000. Stamp duty differs from state-to-state find out how much you could be up for with our handy calculator. But be aware that based on your credit situation.

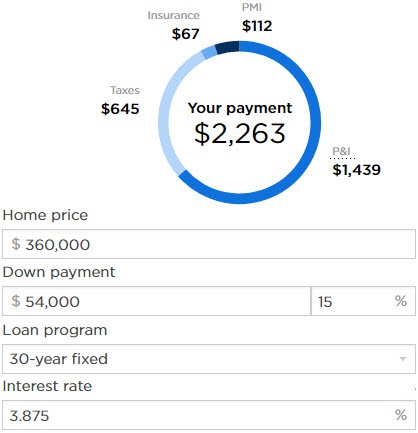

Should I rent or buy a home. Enter your home price down payment interest rate taxes and insurance to get your estimate. What are the tax savings generated by my mortgage.

Choose options for home price down payment loan term and interest rate to see how your monthly payment is affected. Calculate my borrowing power ME N Item - 4 Col c Refinancing. Rates program terms and conditions are subject to change without notice.

Estimate Your Monthly Mortgage Payments. Based on internal survey data from 32016 32018. Estimate a home loan with our Mortgage Calculator or get ahead of your Income Taxes with our Tax Calculators.

Fees for required service that the lender did not allow you to shop separately for when the provider is not affiliated with the lender or mortgage broker. 15 20 30 year Should I pay discount points for A lower interest rate. A down payment of less than 20 often requires the borrower to have private mortgage insurance.

For example lets say youre considering purchasing a 250000 home and putting 20 percent down. Use this mortgage calculator to estimate your monthly mortgage payment. For example you might want to see how refinancing will affect your payment if you opt for a 20-year loan as opposed to a 30-year loan.

This refinance closing cost calculator helps you estimate your fees and costs so youll have an idea of what you can expect to pay. Most UK lenders consider 20 to 30 a low-risk range. Should I rent or buy a home.

If the down payment amount is less than 20 the lender may require PMI if the loan amount is more than 80 of the purchase price. Use our mortgage affordability qualification calculator to estimate how much you can qualify for based on your. But you dont have to put 20 down to buy a house.

15 20 30 year Should I pay discount points for a lower interest rate. Use our mortgage payment calculator to see how much your monthly payment could be. Borrowers within this limit typically receive more favourable mortgage rates.

This free mortgage calculator helps you estimate your monthly payment with the principal and interest components property taxes PMI homeowners insurance and HOA fees. Comparing mortgage terms ie. 5000 down from 5125 -0125.

We are licensed across 20. With a cash back mortgage you get the mortgage principal and a percentage of the mortgage amount in cash. Based on current rates 4 is a safe estimate.

For many home shoppers saving up for a 20 down payment is not easy but it can have significant financial benefits. Use our mortgage calculator to estimate your monthly mortgage payment. A down payment of 20 or more helps you get a lower interest rate and avoid paying private mortgage insurance.

By changing the numbers. Monthly mortgage payments remain the same while principal and interest totals vary with amortization throughout the life of the loan. Should I convert to a bi-weekly.

Some lenders do not impose a maximum limit they assess applications on an individual basis and may accept a debt-to-income ratio of 45 to 50. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. Comparing mortgage terms ie.

How does a 20-year fixed-rate mortgage compare to a 5-year ARM. Try different scenarios on our mortgage calculator but some ways to reduce your mortgage payment are as follows. Improve your credit score.

A down payment of 20 or more will get you the best interest rates and the most loan options. How to Use the Mortgage Calculator. Calculate how much I can save ME N Item - 4 Col c Stamp duty.

Pay Off Your Mortgage Or Invest This Calculator Will Help You Decide

Types Of Home Loans Amerhome Mortgage

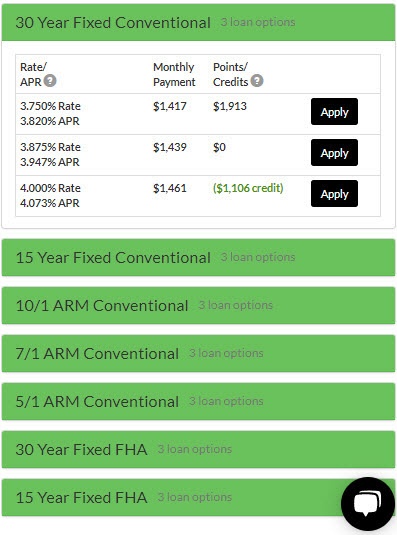

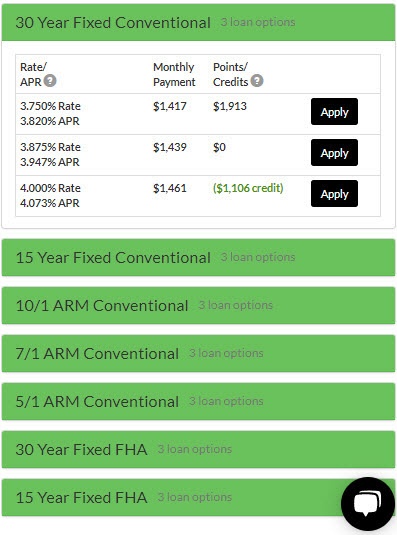

How To Get A Reliable Mortgage Rate Quote In 1 Minute

Mortgage Payment Calculator Refinance Calculator Closing Costs Calculator More

Types Of Home Loans Amerhome Mortgage

How To Get A Reliable Mortgage Rate Quote In 1 Minute

Downloadable Free Mortgage Calculator Tool

/shutterstock_250676278.housing.market.real.estate.crash.mortgage.cropped-5bfc315b4cedfd0026c226cd.jpg)

Mortgage Payment Structure Explained With Example

Mortgage Payment Calculator Refinance Calculator Closing Costs Calculator More

How To Get A Reliable Mortgage Rate Quote In 1 Minute

How Much Is A Mortgage Calculator Quora

How To Get A Reliable Mortgage Rate Quote In 1 Minute

/Mortgage_Rates-final-72f37273e7994683ac3366ebc810881f.png)

Shopping For Mortgage Rates

The Evolution Of Subprime Mortgage Defaults In The United States The Download Scientific Diagram

Downloadable Free Mortgage Calculator Tool

Mortgage Calculator Vic Joshi Mortgage Consultant

Downloadable Free Mortgage Calculator Tool